The Good Ole Days!

Using math in the “real world” is an essential skill for success in life. Even if you inherit a ton of money, you still need to manage it. Standard topics include interest and returns on investments, taxes, and other financial matters. When you tackle “money math”, problems typically involve extended lengths of time–30 yr. mortgages, 10 year savings, etc.

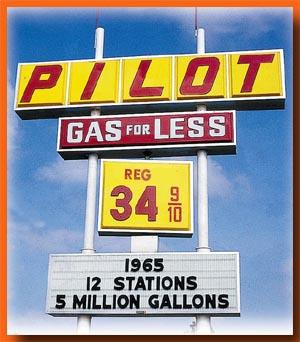

Wow! Fill ‘er up!!

Inflation (and deflation) make dollar amounts “time sensitive”. For example, in the mid-1960s, gasoline was about 35 cents per gallon. Now we pay about $3.50 per gallon. So what does this mean in terms of purchasing power and wages over 50+ years? In 1965, $10,000 was a middle class salary. That’s about $5 per hour. But now, due to inflation, this is not even minimum wage! Here is a website that provides tools to calculate these values using hard statistics.

http://www.measuringworth.com/ppowerus/

So, for gasoline, in 1965, let’s use $3.50 for 10 gallons.

From the website: In 2012, the relative worth of $3.50 from 1965 is:

| $25.50 | using the Consumer Price Index | |

| $19.60 | using the GDP deflator | |

| $26.80 | using the value of consumer bundle | |

| $26.90 | using the unskilled wage | |

| $31.70 | using the Production Worker Compensation |

So in 2012, $25.50 could buy about 7.3 gallons of gas, for the equivalent value of $3.50 in 1965. Two things are obvious:

1. You must adjust for changes in value over time.

2. Our gasoline is a bit more expensive, for sure, but nothing line “ten times as expensive” that you might first think!

Here are a few suggestions for using the calculation tools. First, pick a series of years you’re interested in. Then pick several intervals (e.g. 5 or 10 years at a time).

1. Compare the price of 1 ounce of gold.

2. How do the prices compare for a Corvette? You won’t find Corvette prices…you’ll have to search the net for old ads, etc.

3. Compare the price of food and other commodities.